What Does Mileage Tracker Do?

Table of ContentsMileage Tracker Fundamentals ExplainedWhat Does Mileage Tracker Do?3 Simple Techniques For Mileage TrackerMileage Tracker Can Be Fun For Anyone4 Easy Facts About Mileage Tracker ShownThe Only Guide for Mileage Tracker

.jpg)

A web-based coordinator needs to have the ability to provide you a rather accurate estimate of mileage for the trip concerned. While it may look like an arduous job, the advantages of maintaining an auto mileage log are remarkable. When you enter the practice of tracking your mileage, it will certainly come to be second nature to you.

Our notebooks are made using the highest possible high quality products. If you have any kind of concerns, don't hesitate to reach out - email us at!.

For small company proprietors, tracking gas mileage can be a tiresome but necessary job, especially when it comes to making the most of tax obligation deductions and managing business expenses. The days of manually recording mileage in a paper log are fading, as digital gas mileage logs have actually made the process far more effective, accurate, and hassle-free.

The 2-Minute Rule for Mileage Tracker

Among one of the most substantial advantages of utilizing a digital gas mileage log is the moment it saves. With automation at its core, electronic devices can track your journeys without requiring manual input for each trip you take. Digital gas mileage logs take advantage of general practitioner modern technology to immediately track the range traveled, classify the journey (e.g., organization or individual), and create comprehensive reports.

%20(1).webp)

Time-saving: Conserve hours of manual data entry and stay clear of human mistakes by automating your gas mileage logging process. For little service proprietors, where time is cash, using a digital gas mileage log can significantly improve everyday operations and free up more time to focus on expanding the service.

Some organization proprietors are unclear concerning the advantages of tracking their driving with a mileage application. In a nutshell, tracking gas mileage during service travel will help to increase your gas efficiency. It can likewise help decrease lorry wear and tear.

Some Known Incorrect Statements About Mileage Tracker

This short article will certainly disclose the advantages connected with leveraging a mileage tracker. If you run a shipment company, there is a high possibility of investing lengthy hours when driving daily. Local business owner usually discover it tough to track the ranges they cover with their lorries given that they have a lot to consider.

Because instance, it means you have all the opportunity to enhance that facet of your business. When you utilize a gas mileage tracker, you'll have the ability to tape-record your costs better. This assists your total financial records. You would certainly be able to minimize your expenses in specific areas like taxes, insurance, and lorry wear and tear.

Mileage monitoring plays a large function in the lives of numerous drivers, employees and company decision manufacturers. What does mileage tracking mean? And what makes a mileage tracker app the best gas mileage tracker app?

9 Easy Facts About Mileage Tracker Shown

Mileage monitoring, or gas mileage capture, is the recording of the miles your drive browse around these guys for service. There are a view it now couple of factors to do so. Prior to the TCJA, W-2 staff members would track miles for tax reduction. However, this is no more an option. Most full time workers or contract workers videotape their gas mileage for compensation purposes.

It is essential to note that, while the gadget uses general practitioners and activity sensor capabilities of the phone, they aren't sharing areas with employers in actual time - mileage tracker. This isn't a security effort, yet a more hassle-free means to record business journeys traveled precisely. A free mileage capture application will be tough to come by

Mileage Tracker Can Be Fun For Anyone

Mileage apps for private vehicle drivers can set you back anywhere from $3 to $30 a month. Our group has decades of experience with mileage capture. One thing we don't use is a single-user gas mileage application. We understand there are a great deal of workers around that require an app to track their gas mileage for tax and reimbursement objectives.

There are a significant number of advantages to utilizing a mileage tracker. For business, it's internal revenue service compliance, boosted visibility, lowered mileage fraudulence, decreased administration. For service providers, it's mostly regarding tax obligation reduction. Let's check out these benefits even more, starting with among the most vital have a peek here reasons to execute a gas mileage monitoring application: IRS conformity.

Expense repayment fraud accounts for 17% of company expenditure fraudulence. With a computerized mileage tracking application, business receive GPS-verified gas mileage logs from their staff members.

Mileage Tracker Things To Know Before You Buy

A good mileage tracking application supplies all the above. The finest comes with a group responsible for gathering the gas mileage details, handling repayments and offering understandings right into your labor force. Automating gas mileage tracking boosts efficiency for those in the area and those hectic completing the logs. With a gas mileage application, logs can conveniently be submitted for repayment and maximize the administrative work of confirming all staff member gas mileage logs.

Once more, professionals mainly use service mileage trackers to keep track of their gas mileage for tax obligation deductions. Some gas mileage trackers are much better than others. What makes the ideal mileage tracker app? Right here are a couple of manner ins which particular applications set themselves above the rest. Automated mileage tracking advantages the company and its employees in numerous ways.

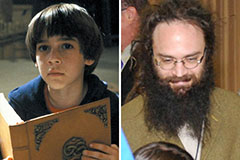

Barret Oliver Then & Now!

Barret Oliver Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!